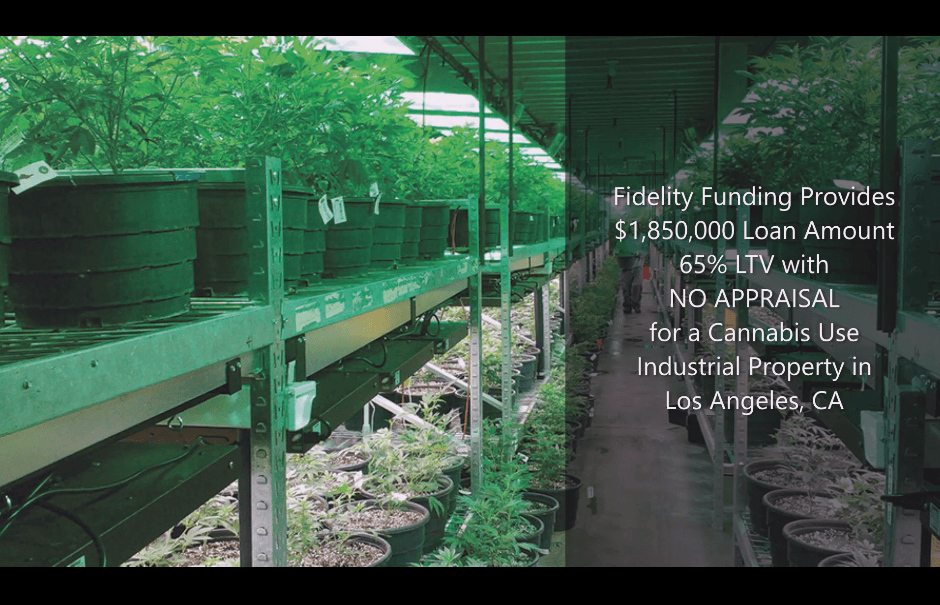

Fidelity Funding Provides a $1,850,000 Cannabis Real Estate Loan for an Industrial Property in Los Angeles, CA

Fidelity Funding Funds Conventional Purchase Loan Denied by 7 Lenders in Less than 28 Days

May 21, 201915-Year Refinance Mortgage: A Smart Move In 2019 – Fidelity Funding

May 24, 2019

Fidelity Funding has provided a $1,850,000 hard money refinance loan in Los Angeles, California.

The property is a Cannabis-use industrial property that is comprised of 25,120 square feet. The property did NOT have an appraisal conducted, and was valued based on the comparable sales in the surrounding areas. The loan-to-value was 65%.

Loan documents were drawn and delivered to escrow within 24 hours of submission and was funded 3 business days later. Total process of loan was 5 business days.

In addition to lending on single family residences, Fidelity Funding provides financing on a wide array of property types including office, mixed-use, retail, industrial, both non-owner occupied and owner-occupied.

As for Fidelity Funding’s typical borrowers, our customer base is fairly diverse; borrowers range from builders looking for rehab financing, to individuals who are looking to purchase or refinance an investment property. Fidelity Funding is a San Diego hard money lender, Los Angeles hard money lender, and San Francisco hard money lender, Orange County hard money lender and provides financing to borrowers who are unable to obtain credit from traditional lending institutions or need to close quickly on a property.

ABOUT FIDELITY FUNDING

Fidelity Funding specializes in providing loans to almost every type of property, both residential and commercial. We arrange both lst, 2nd, and 3rd trust deeds. We provide Hard Money Loans, Alternative Financing Loans, Commercial Loans, Residential Purchase and Refinance loans, Government Loans, Reverse Mortgages, Business Capital Loans, Construction loans, Fix & Flip loans, Bridge loans and much more. We offer low rates and a simplified loan process.

Loans are made or arranged by Fidelity Funding pursuant to California Bureau of Real Estate #00785027; NMLS ID 304265. The information above is deemed reliable but is not guaranteed.

#hardmoneylender #hardmoney #hardmoneyloans #hardmoneyloan #realestate #finance #funding #privatemoney #businessfinancing #businesscapital #commerciallending #residentiallending #realestatefinance #brokers #realtors #investors #homebuyers #homeowners #realestatemarket #housing #housingmarket #mortgagebrokers #celebrityhomes #hardmoneylosangeles #hardmoneycalifornia #fidelityfunding #businesscapitalfunding #businesscapital #smallbusinessowners #smallbusiness #smallbusinessowner #merchantcashadvance #mca #privatefunding #fidelityfunding #conventionalloans #reversemortgage #cannabisrealestateloans #cannabisloans #cannabis